About the research

Frontier Economics was commissioned by Tech City UK, who planned to update its annual report; a data-rich analysis of the UK’s thriving digital economy and tech clusters. Frontier Economics assisted with the collection, tabulation and analysis of specific business sector datasets for the preparation of the report, “Tech Nation 2017”. The report describes:

- The latest digital economy trends;

- The growth of 30 leading digital tech clusters; and

- The wider impact of the digital tech sector on business, employment and the economy.

Tech City UK was launched by the UK Prime Minister in 2010 to support the East London tech cluster, and the organization has grown to now support the development of the digital tech sector across the UK.

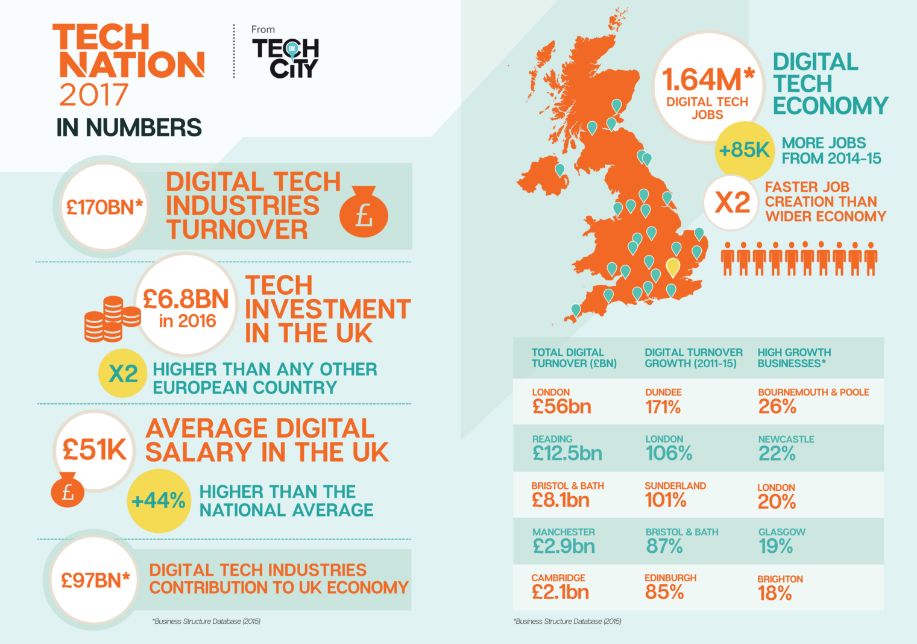

The report was published in March 2017 and highlights key findings for the UK, compares headline figures for 30 cluster cities and includes interactive data visualisations based on the results. The report hails the UK as the digital capital of Europe, topping the charts on digital tech talent, collaboration and investment, securing two times more in investment than any other European country. The additional headline figures from the research also highlight the vast growth of the sector, which now has an annual turnover of £170bn and makes a £91bn contribution to the UK economy.

Research findings also inform Tech City UK’s on-going efforts to support and showcase UK digital tech. In addition, the report is beneficial to investors, educators and policy makers as it helps to promote greater understanding of UK tech business and ecosystems.

The success of the report has sparked curiosity among many readers, including the Department for Culture, Media & Sport (DCMS) and the Greater London Authority (GLA) who have requested additional information on the findings.

Methodology

Frontier Economics used a combination of ONS administrative and survey datasets – Business Structure Database (BSD) and Annual Business Survey (ABS) to develop estimates on the size and geographic location of industries and sub-industries for the UK’s “digital tech” industries. Location quotients (LQ) were produced to quantify how concentrated the high-tech industries were in a region as compared to the nation.

Frontier Economics produced aggregations of business counts, employment turnover and Gross Value Added (GVA) estimates to measure the value of the goods and services produced. The BSD included Standard Industrial Code (SIC), location, employment and turnover data for all UK businesses registered for PAYE/VAT. The ABS had 2007 SIC, location and detailed financial data which allowed the estimation of approximate GVA figures.

The project also added two new bits of tabulation (from earlier Tech Nation reports) – generating estimates of firm entry and exit, and looking at so-called high-growth firms which may be defined as either falling within a certain percentile growth distribution or achieving certain growth targets over a defined period of time. The data was used to show trends in levels, growth, and geographic concentration of the digital tech sectors throughout the UK.

Research findings

The key findings for the report show that the UK is the digital capital and clear leader of Europe when it comes to tech investment, digital skills and collaboration within ecosystems. The report analysed more than 1,000 data points, over 2,700 responses from an online survey (carried out by Tech City UK) of digital tech founders and employees and incorporated insights from over 220 community partners across the UK. The report describes the following key findings:

- In 2016 UK digital tech investment reached £6.8 billion, which is more than double any other European country and significantly more than its closest rival, France, which secured £2.4 billion.

- The UK is home to 8 of Europe’s top 20 universities, more than any other European country;

- London hosted 22,000 Digital Tech meet ups in 2016, that’s three times as many as in Berlin, Amsterdam or Paris;

- The turnover of digital tech businesses reached £170 billion, an increase of £30 billion in just five years and is growing at twice the rate of the wider economy and is key to boasting the UK’s wider economy, with a contribution of £97 billion in 2015;

- There are now 1.64 million digital tech jobs in the UK, and the digital sector is creating jobs two times faster than the non digital sector;

- The average advertised salary for digital-tech jobs has now reached £50,663 a year, 44% higher than the average non-digital salary at £35,155; and,

- The economic contribution of the UK digital tech worker is large and growing, and is now almost twice as high as the non digital worker.

Impact of the research and findings for policy

Tech Nation 2017 confirms that the digital tech sector is one of the UK’s economic success stories. During her Tech Nation 2017 report launch speech, the Secretary of state for DCMS, Karen Bradley noted that “the combination of highly paid jobs and inward investment is why digital sits right at the heart of the Government’s Plan for Britain – to deliver a country that is stronger, fairer, more united, and more outward-looking than ever before”.

With 1,000+ data points, 61 tech company case studies and 260+ community partners, Tech Nation 2017 is the most comprehensive report to date on the digital tech economy. It has quickly gained momentum, generating the following interest:

- 60,000+ online report views;

- 20,000+ number of unique users reached through website;

- 3,400 downloads, of which 1,060 were by readers starting or growing a digital business;

- 8,000 print circulation;

- 2,000+ event attendees at 7 events across the UK; and,

- 50+ requests for further analysis from local authorities, journalists, investors, academics, community groups and tech businesses.

As well as the data analysis carried out by Frontier Economics, Tech Nation 2017 also contains supporting feedback captured in a survey, and supplementary data from a range of sources, including Burning Glass salary analysis and Pitchbook investment data. Together these analyses have produced six recommended areas for focus;

- skilling up for digital businesses;

- gender diversity in the sector;

- access to finance at every stage of growth;

- boost digital connectivity;

- attract the best and brightest global talent; and,

- physical spaces for company formation and growth.

The UK Prime Minister, Theresa May has stated that Britain already leads the world when it comes to new technology and states that “through close co-operation between government and our tech industry we will help to ensure that Britain remains one of the most competitive places in the world to start and grow a tech business. We will expand the scope of our digital tech industries, funding Artificial Intelligence, robotics, 5G, smart energy and more. We will broaden their reach across the UK, create new Institutes of Technology, and reinvigorate STEM [science, technology, engineering and mathematics] and digital education to equip young people for the workplaces of the future.”

There has been considerable interest in the report from a range of organizations, including local authorities, academia and businesses. There is interest in doing further research to expand the analysis to include all local authority areas and Tech City UK is in discussion with ONS about taking this and further analysis forward using ONS research data.

Read the report

Tech Nation 2017: http://technation.techcityuk.com/

Publications and outputs

Secretary of State Karen Bradley: Tech Nation 2017 launch speech

https://www.gov.uk/government/speeches/secretary-of-state-karen-bradley-tech-nation-2017-report-launch-speech